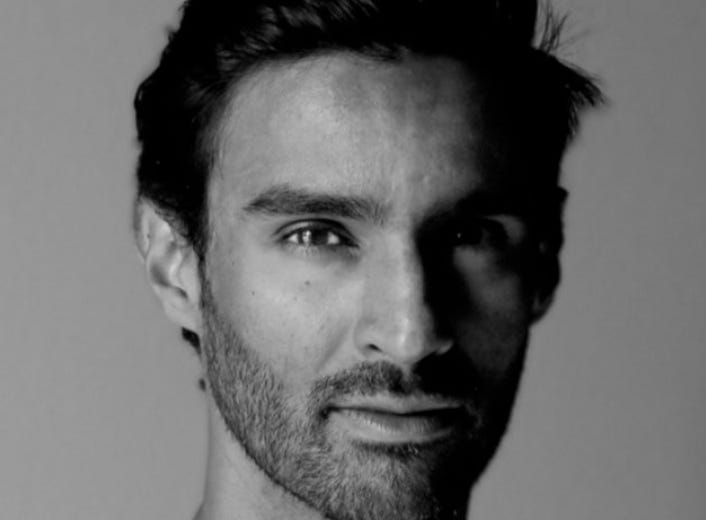

Episode 23 of the BIG5D Podcast features Tariq Sheikh, founder and CEO of Postpay, A Dubai-based buy now, pay later platform. This is a branch of eCommerce and fintech that allows consumers to pay for purchases in installments, often interest-free. The model is popular worldwide, in particular among younger consumers.

Postpay was formed in 2019 by Sheikh, a former management consultant, and his co-founder Dani Molina, who was previously co-founder and CTO of Spanish BNPL Aplazme.

Sheikh and Molina launched their product in 2020. Around the same time, several other companies did the same thing in the Gulf region. These include Shahry, Spotti, Tabby, and Tamara.

“It happened very quickly. And we were all in the know, I guess. I knew that there would be at least two other players coming relatively soon,” Tariq said.

BNPL is now a highly competitive market in MENA. It reflects the global buy now pay later market, which is also hyper-competitive and lately has been attracting big-dollar M&A. The most notable deal to date was Square's acquisition of Australian-American BNPL Afterpay for $29 billion. We also just saw PayPal acquire Paidy in Japan, for about $3 billion.

In June, Afterpay and its investment arm, AP Ventures invested $10 million in Postpay.

And we've also seen many smaller regional acquisitions, Australia’s ZipCo recently acquired the remaining shares in Payflex, a South African buy now pay later, following a minority investment back in April. Zip has already acquired Spotti, the UAE buy now pay later platform, which continues to operate independently.

So there's a lot going on in this space. And we wanted to get somebody on the podcast to tell us all about it.

Tariq was kind enough to come on and answer all our questions about how the business works, some of the big challenges it is facing, the competitive environment, and more.

Here is the full interview with Tariq on YouTube.

Episode 23 of the BIG5D Podcast is supported by Matchcraft, a global martech company powering local search, social, and display campaigns. Matchcraft has introduced “Powered By”, a solution that productizes its suite of APIs, giving third-party platforms access to the technology behind its flagship AdVantage platform. Visit Matchcraft.com for more.

Here are some key passages from Episode 23.

What is Postpay’s geographic range?

“Today we are 100% live and operational in the UAE. Saudi Arabia is next, followed by Kuwait, Qatar, and Bahrain. The zone that we consider Postpay territory is anywhere from Turkey to South Africa, and from Morocco to Malaysia and Indonesia. We have a Sharia compliant product, it resonates strongly in the the part of the world.”

Why did so many BNPL platforms emerge in MENA in 2019-20?

“I guess it's driven by the market, right? It's clear that it was a big, big success in the US and in Australia and in Europe. And the Middle East often emulates what happens in the West, and improves it and applies it locally. So this is essentially what happened…We needed it here. There was a strong demand.”

Why has BNPL become so popular?

“When we talk about Gen Z and millennials, this is a population that grew up through financial crisis, in 2007-2008 when there was a lot of uncertainty…in the job market. There was a lot of uncertainty in the banking industry and in the financial service sector. There was a generational shift away from banking, finance and the financial sector. ….

“And so this generation tends to steer away from using credit cards and other traditional financial products. They prefer to use cash. With buy now pay later, when it's very clear — this is what I'm doing and this is how much it's going to cost — there's a lot of transparency. But also important is the instant gratification. This generation wants a couple of things. One, they want things now. And two, they want things that are free.”

How do you respond to BNPL critics who raise concerns that BNPL users may get overextended?

“When we talk about buy now pay later, we're talking about $200, $250, you know, at a cap, maybe $300. If you really go far up, maybe $500. But the limits are a lot a lot lower than what we talk about when you talk about credit limits. So even if we go and dig into a credit bureau and the debt burden ratio, $200, $300 is not going to make a huge difference for the vast majority of the population.

“So when we look at it from a consumer perspective, first of all, we're working with our customers. We're not a debt collection agency. Customers are not able to check out with multiple installment plans ongoing, if if they haven't paid installments off. So they can never get into a situation where they become a revolver. There's nothing like that in buy now pay later.”

What are some of the dangers posed by this incredibly competitive environment?

“There are two major [forms of differntiation]. The first one is constructive differentiation. And the second is destructive differentiation…Destructive differentiation typically comes in two forms and tends to not bode well for any player in the market. First it is lowball pricing, which is unfortunate. It always happens. And it's typically in the unit costs. So it's variable fees, fixed fees that we charge as gateways to the retailers.

“And then the other comes in many different forms, but it could be termed as marketing investments…to boost sales in other ways. I'm not a big believer in those in those two because I believe in sustainability.”

What metrics signal success or failure in the BNPL business?

“You have two major ones. Conversion rates and AOVs [average order values]. Conversion rate come from our market. So our customer base, our returning customer base using the retailer. And also the fact that the same customer that would not have checked out because the price was too high, is now able to check out.

“And the AOV impact, obviously, is that the hypothetical checkout amount is a lot higher, they're able to put a lot more in their basket. And, you know, and check out with more. So those are the two main metrics.

‘In addition to that, we look at items per order. So this is another metric that we look at, which is similar to average order value, but it also looks at, are they just buying more things? Or are they buying more expensive things? So it's a nice way to dive down a little bit more, we also look at return rates. And that's important in a region where logistic costs are enormous.”

This transcript was lightly edited for length and clarity.

Upcoming Events

The BigFive Summit

16-18 May 2022

Workshop 17

Cape Town, South Africa

Stay tuned for more information. Questions? Write to us at info@bigfivedfigital.org.

BIG5D Podcast Episode 23: Postpay Founder and CEO Tariq Sheikh