The Africa B2B Tech Report

Issue No. 108. Africa-Middle East B2B tech news & insights for 10 January 2026.

Welcome to the Africa B2B Tech Report. We explore the business of African tech.

The Report is brought to you by Charles Laughlin, the Co-founder &Chief Content Officer of BigFive Digital, a media and events firm that hosts the annual BigFive Summit in Cape Town. Charles is an independent journalist, podcaster, and event producer.

The Business of African Tech Week in Review, 3-9 January 2026

This week, we curated a compelling collection of stories that, in many respects, reflects the direction we expect the Business of African Tech to move in 2026.

Based on the articles provided, the current landscape of the African tech ecosystem can be organized into three distinct categories: Market Consolidation & Investment, Technological Evolution & Digital Skills, and Infrastructure & Regulatory Dynamics.

Market Consolidation & Investment

We have noted a “survival of the fittest” theme as we exited 2025 and entered 2026. We are seeing established tech players acquire specialized infrastructure to lock in market dominance.

Strategic M&A: Flutterwave’s (up to) $40 million all-stock acquisition of Mono is a landmark deal that promises to transform Flutterwave from a payment processor into an infrastructure owner, giving it control over the open-banking tools that many of its rivals use.

Broad Consolidation: In 2025, we saw 60 major acquisitions across the continent, primarily driven by fintechs looking to expand their footprint.

Strategic Funding: We saw the following deals this week.

Kayko (Rwanda): Raised $1.2M to bridge the credit gap for informal SMEs.

Green Pay (Ivory Coast): Received state-backed investment from CDC-CI to boost financial inclusion.

Business for Teens (Egypt): Secured pre-seed funding to expand financial literacy across the GCC.

Technological Evolution & Digital Skills

This week we saw more evidence that Africa is moving beyond basic digital adoption toward specialized AI solutions and indigenous talent development.

AI Integration: Innovators are moving past generic AI to address real African challenges. The top AI products of 2025 included AI for indigenous language support and sign language translation. South Africa’s Adbot (which also announced new funding this week) is using AI to automate full-agency marketing workflows for small businesses.

The Mobile-App Shift: In Kenya, mobile apps have eclipsed websites as the digital entry point for e-commerce. High smartphone penetration and integrated mobile money (M-Pesa) are the primary drivers of this shift.

Leadership & Education: WeThinkCode has transitioned to new leadership under CEO Ashmita Singh. This change marks a new chapter in scaling high-end digital talent to meet the growing demand for software engineers across Africa.

Infrastructure & Regulatory Dynamics

This week again showed us that, as tech becomes central to the continent’s economy, governments will increasingly intervene through taxation, fines, and infrastructure mandates.

Government Intervention: Citing the Nigeria Tax Administration Act 2025, the government is now utilizing the very tools fintechs built — real-time digital accounting — to recover unpaid taxes directly from bank accounts.

Connectivity Bottlenecks: Nigeria’s 70% broadband goal appears to be at risk. While subsea cables are plentiful, “last-mile” inland fiber is being stalled by steep right-of-way fees and infrastructure damage.

Regulatory Scrutiny: The Nigeria data commission $5 million fine against TikTok highlights a growing tension between global social platforms and local privacy laws.

The following is a collection of stories that we have tracked over the past week that matter to the Business of African Tech. Click the headlines to view the original articles.

Flutterwave snaps up Nigerian open banking startup Mono

Top African fintech Flutterwave acquired the Nigerian open banking startup Mono in an all-stock deal worth up to $40 million. Flutterwave had several motivations for the acquisition, including deepening its open banking push, enabling faster merchant onboarding, improving identity verification, and enabling seamless account-to-account payments across its African financial ecosystem.

Flutterwave now dominates the infrastructure its rivals rely on

The Mono acquisition means Flutterwave controls critical open-banking infrastructure that rival fintechs rely on for data and payments. This consolidation raises both competitive and regulatory concerns.

AI-startup Adbot secures new investment

Cape Town-based AI digital marketing startup Adbot has raised a new investment from Montegray Capital (amount not disclosed), which Adbot will use to expand its marketing automation platform that enables lean teams to handle full agency workflows. Former FNB CEO Michael Jordaan leads Montegray Capital.

Egyptian edtech Business for Teens raises pre-seed, plans expansion

The Egyptian edtech startup Business For Teens has secured a six-figure pre-seed funding round. The company will use the proceeds to expand its project-based business and financial literacy programs for teenagers across Egypt and the Gulf Cooperation Council (GCC).

A look at the 60 major African M&A deals of 2025

In 2025, Africa’s tech ecosystem saw record consolidation with sixty major acquisitions. Fintech led the trend as strong startups acquired struggling peers to expand market share.

State-backed fund acquires stake in Ivorian fintech Green Pay

Ivory Coast’s state-backed fund, CDC-CI, acquired a stake in fintech Green Pay, joining fellow investor Orange, to accelerate digital payments, enhance financial inclusion, and scale regional impact.

What were Africa’s top AI products of 2025?

In 2025, African innovators leveraged AI to solve local challenges, creating impressive tools for sign language translation, multilingual banking, automated app building, and indigenous language support.

In Kenya, apps overtake websites as the entry point to e-commerce

Mobile apps have overtaken websites as Kenyans’ preferred entry into e-commerce platforms, driven by high smartphone penetration, improved user interfaces, and seamless mobile money integration.

Singh named CEO of African digital skills academy WeThinkCod

The African digital skills academy WeThinkCode has appointed Ashmita Singh as CEO to drive its next growth phase. Outgoing leader Nyari Samushonga becomes WeThinkCode’s chairperson, focusing on scaling digital skills impact across Africa. Both leaders are former BigFiveD Podcast guests.

Is Nigeria’s 70% broadband penetration goal on track?

Inland fiber remains expensive in Nigeria due to multiple taxation, high right-of-way fees, and infrastructure damage, hindering the government's goal of achieving 70% broadband penetration.

Rwanda’s Kayko raises $1.2M to extend credit to informal SMEs

Rwandan fintech Kayko has raised $1.2 million in seed funding to expand its data-driven platform, helping informal SMEs access formal credit through digitized business records.

Banks, fintech on deck to help Nigeria recover unpaid taxes

Under the Nigeria Tax Administration Act 2025, the government will use banks and fintechs as agents to recover unpaid taxes directly from debtors' financial accounts.

TikTok challenges Nigerian privacy breach fine

TikTok is contesting a $5 million fine from Nigeria’s data commission for alleged privacy breaches, arguing that the penalty is unjustifiable. The affair is an example of the growing local regulatory scrutiny global tech firms are facing in Africa.

Sponsored Message

What is Temu’s secret weapon in South Africa?

Temu’s “secret weapon” in South Africa is an innovative customs prepayment system, allowing shoppers to pay import duties upfront to expedite clearance and last-mile delivery.

Piggyvest reports ₦1.3 trillion in 2025 payouts

In 2025, Nigerian fintech Piggyvest reported record payouts of ₦1.3 trillion to over six million users, representing a 56% increase driven by its new in-house infrastructure.

MTN Nigeria, Thunes partner for instant X-border remittances

MTN Nigeria’s MoMo PSB has partnered with Thunes to enable instant cross-border remittances. This deal allows millions of Nigerians to accept funds from global markets directly into their wallets.

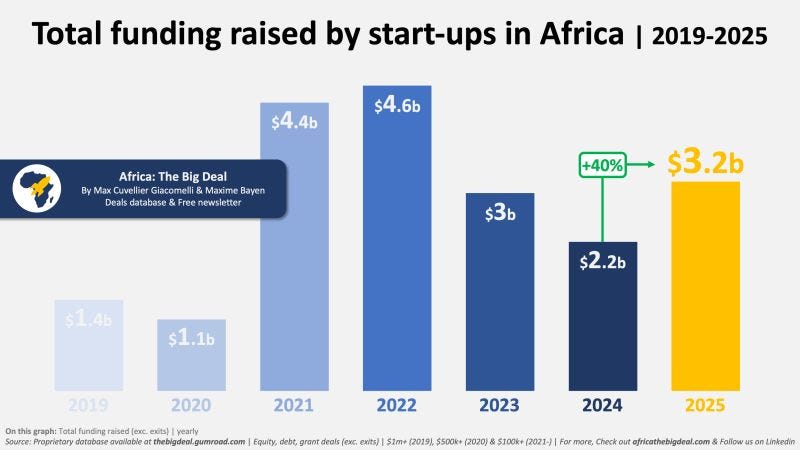

Each issue of The Report features a chart or infographic that we believe tells an important story about the region’s B2B tech ecosystem.

The numbers are in for startups in 2025

As we often do when we want to find out what is going on in African tech investing, we turn to Max Cuvellier Giacomelli and Africa: The Big Deal. And this week, we share their final numbers for startup investing in 2025.

Here are a few highlights.

African startups raised $3.2 billion in 2025. This does not include exits.

This was a 40% year-over-year increase, with 2025 representing an end to a two-year slide in African startup funding.

The 2025 difference-maker was not volume, but size. There were 69 raises in 2025 worth $10 million or more and eight valued at $100 million+.

In case you missed it

Sponsored Message

The 2026 BigFive Summit in Cape Town

Tickets are now available for the 2026 BigFive Summit, 24-26 March at Innovation City Cape Town. This year’s theme is “The Business of African Tech”.

Generous early bird rates (25%+ savings) are in place through February, so it pays to make an early decision to join one of the Continent’s best technology events.

Do you want to get involved in the 2026 BigFive Summit? Follow the links below. Or just reach out to us at big5dtv@gmail.com to start a conversation.

BigFive Summit sponsors receive a host of benefits, including branding, stage time (with shareable video content), exclusive event sponsorships within the Summit (dinners, giveaways, tea breaks, etc.), early and exclusive access to the Summit delegate list with contact details, curation of meetings, and much more.

Whatever your business stage or budget level, there is a sponsorship opportunity for you. Learn more in our sponsorship prospectus.

Fascinating report. The Flutterwave-Mono acquisition really changes the competitive dynamics when the infrastructure owner also competes downstream. I wonder if other players wil start building their own rails or if we'll see more consolidation. That Temu customs prepayment system is smart, removing friction at exactly the bottelneck that kills most cross-border e-commerce. The M&A trend makes sense given funding constraints, but seems like 2026 will separate those with real moats from those just burning to grow.