The Africa SMME Tech Report

Issue No. 80. Africa SME tech news and insights for 14th June 2024.

This edition of the Africa SMME Tech Report is brought to you by Realm Digital

Your Trusted Strategy and Technology Partner

Empowering industry leaders through innovative business solutions

Please visit them at RealmDigital.com to learn more.

The Africa SMME Tech News Digest

SMME Tech News & Insights for 14th June 2024

UAE’s NOW Money Raises $4 Million

NOW Money, a UAE fintech startup that helps GCC migrant workers with remittances and payroll, has raised a $4 million equity round. The investor in this round was not disclosed.

Now Money was founded in 2016 by Ian Dillon and Katharine Budd. Last year it was acquired by a group led by the top executives of the payroll and cloud HR software firm Yomly (formerly Emirates HR).

The company says the new capital is “the second round of funding for the company since its acquisition led by Mark Nutter and Nicolas Andine in 2023.”

The new funding will be used to “scale its operations and enhance its technology product offerings.”

Nutter is Yomly’s chairman (and former CEO) and Andine is the current CEO of both Yomly and Now Money.

NOW Money was founded to serve an underserved community — transitory workers in GCC who were chronically underbanked.

Now under its new ownership and leadership, NOW Money is emphasizing its social impact positioning. The company refers to itself as an "inclusive banking and payroll fintech”.

And in his statement on the funding. CEO Andine leaned into this framing.

“We are thrilled to have secured this investment, which underscores the confidence in NOW Money’s vision and potential positive socio-economic impact,” said Nicolas Andine, CEO at NOW Money.

“This funding will be instrumental in accelerating our growth trajectory, fueling innovation, and advancing our mission of financial inclusion. With the support of our investors, we are poised to make significant strides in expanding our reach and enhancing the accessibility of banking services for low-income individuals in the GCC region.”

In addition to its payroll and digital banking services, NOW Money also provides financial education to its end users.

While the new investor was not named, they did provide a statement.

“We believe in the transformative potential of NOW Money’s innovative approach to financial inclusion. We are excited to partner with NOW Money on their journey to empower underserved communities with access to essential financial services. This investment reflects our confidence in NOW Money’s ability to drive positive change and create lasting impact.”

NOW Money co-founder Budd is a past guest on the BIG5D Podcast.

Recommended Reading

The following is a curation of content from around Africa and the world related to big tech, digital marketing, small business, startup life, venture funding, M&A, and more. Please vote with your clicks to tell us what we should curate for you in future editions.

LayUp Advances Lay-By Payments in Africa

Polygon Expanding Africa Network

Flutterwave, Chipper in Line for Kenya Payments License

60% of African Banks are Digitzing Operations

A Look at AI Regulation in Africa

Is Video AI’s Next Battleground?

SA Couriers See Both Sides of Global Etail Entry

Egyptian Fintech Sahl Raises $6 Million

Finalists Named for ASME Innovation Showcase

Kenyan Banks in Market Share Race with Digital Challengers

Will Retail Media Cool Off in 2025?

From the 2024 BigFive Summit

The 2024 BigFive Summit (19-20 March) in Cape Town featured multiple high-impact presentations, panels, and fireside chats. We will continue to share a 2024 Summit video in each edition of this newsletter.

Today we feature a talk by Nic Rawhani. Nic is the Co-founder & CEO of Vula, a UK-based fintech company that calls itself an “AI funding agent.” “Closing the SME Funding Gap” gap (he estimates there is about $330 billion in unmet SME funding demand), using AI was the theme of Nic’s talk at the Summit.

In this clip, Nic shares an illustration of just the kind of SME Vula seeks to help, a peanut butter manufacturer named Joyce. Nic says there are millions of Joyce’s in Africa. These are small, often established businesses that struggle to access capital largely because banks see them as too costly to service.

Using AI to make it easier and more efficient for SMEs to apply and for banks to make lending decisions is how Vula intends to close the massive SME funding gap.

Please enjoy the full interview with Nic on our YouTube channel.

Found on LinkedIn

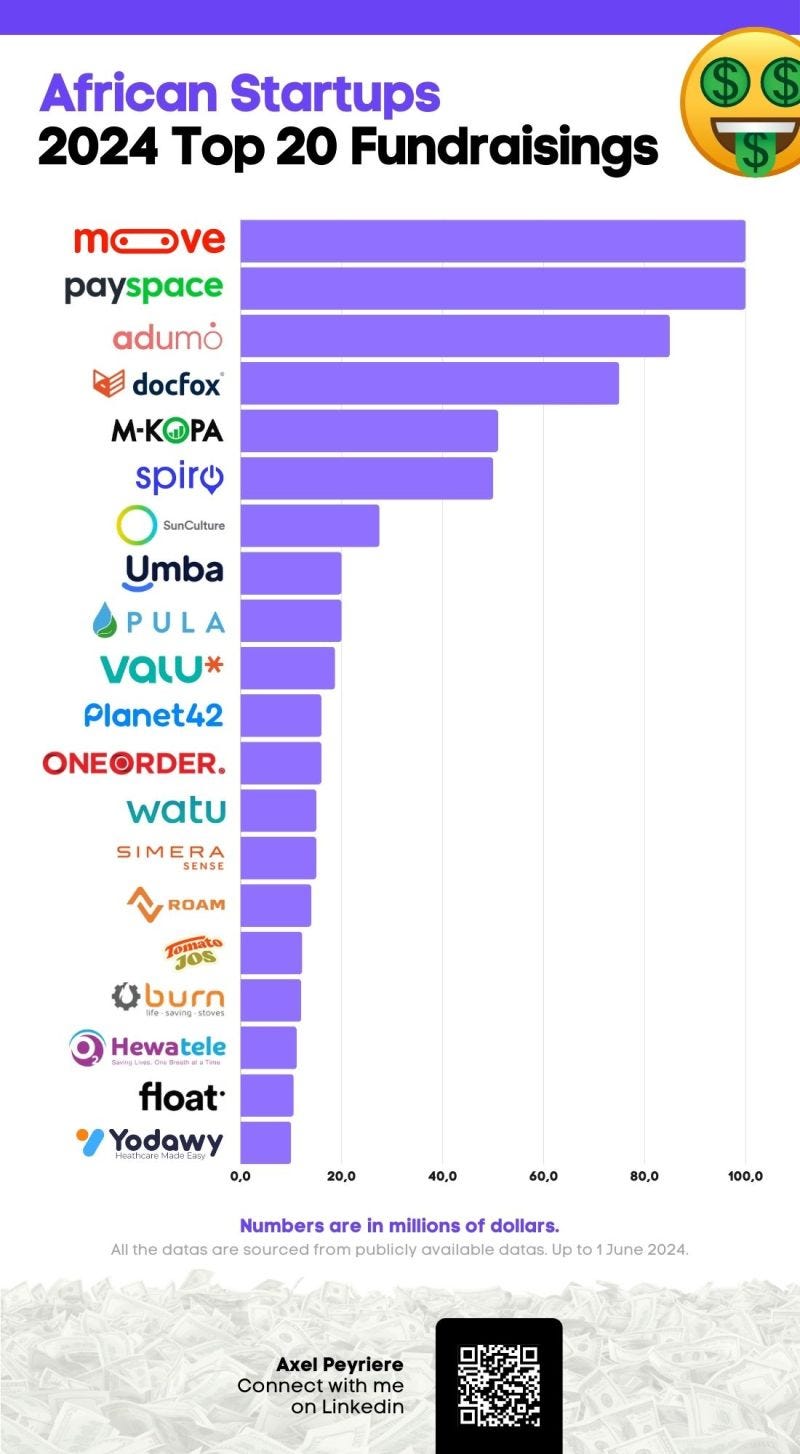

We often share notable infographics that we come across while pursuing LinkedIn. This graphic, again courtesy of Axel Peyriere, shows the top African startup funding rounds thus far in 2024. The rounds include equity, debt, and M&A.

Build Your Brand with BigFive

Do you want to speak directly to BigFive Digital’s high-powered audience of founders, investors, and corporate leaders? Write to us at info@bigfivedigital.org and we can discuss partnering to create original, high-impact content for your organization. Here are just a few ways we can work together:

Sponsor BigFive Digital in-person and virtual events

Sponsor the Africa SMME Tech Report Newsletter & BIG5D Podcast

Send branded campaigns to our email marketing list

Launch bespoke events and content (in-person/virtual events, masterclasses, podcasts, newsletter articles, reports, and more)

Create original market research. Work with us to design and execute surveys, digital focus groups, qualitative interviews, etc. to establish thought leadership, support strategic decision-making, and more.

Our team of journalists, digital marketers, investors, and senior corporate leaders will work with you to ensure that your message connects with our influential audience.