The Africa SMME Tech Report

Issue No. 82. Africa-Middle East B2B tech news & insights for 19 July 2024.

This edition of the Africa SMME Tech Report is brought to you by Realm Digital

Your Trusted Strategy and Technology Partner

Empowering industry leaders through innovative business solutions

Please visit them at RealmDigital.com to learn more.

The Africa SMME Tech News Digest

SMME Tech News & Insights for 19th July 2024

Behind UAE AI Startup Sentient Labs’ $85M Seed

Sentient Labs is a Dubai-based AI Blockchain startup that has recently raised an attention-grabbing $85 million seed round.

The round was led by Founders Fund, Pantera Capital, and Framework Ventures. Notably, Founders Fund is backed by the billionaire Peter Thiel.

Other investors include Arrington Capital, Canonical, Dao5, Delphi, Dispersion, Ethereal, Folius, Foresight, Hack VC, Hashkey, Hypersphere, IDG, Mirana, Nomad, Primitive Ventures, Protagonist, Republic, Robot Ventures, Sky9, Spartan, Symbolic Capital, Topology, and others. A popular round, it seems.

Sentient Labs was founded this year by Sandeep Nailwal, Pramod Viswanath, and Himanshu Tyagi. Nailwal is the co-founder of Polygon Labs. Viswanath and Tyagi are academics.

OK, so what does Sentient Labs do? The company is building an open-source AI platform. Its stated aim is to “democratize AI development”.

OK, what does that mean?

Essentially, the system, according to Abu Dhabi SME Hub, “rewards engineers for tasks such as data labeling and refining, which are essential for training AI models. This platform utilizes software from Polygon, which is also venturing into the AI space. It aims to build a community-driven open AGI platform, leveraging blockchain technology via Polygon.”

Sentient seems focused on making AI more inclusive, or democratic, and it positions itself against “Big AI” players like Google, Microsoft, and Open AI.

“We’re not just another AI project,” co-founder Tyagi said. “We’re building an open world through blockchain to achieve transparency and fairness. When our AI is used, everyone who contributed will be rewarded through the blockchain protocol.”

We have seen other companies emerge globally intending to make a safer AI.

For example, Ilya Sutskever, the former Open AI chief scientist who played a role in Sam Altman’s brief ouster last year, is now trying to build something he calls “safe superintelligence.”

The company is called Safe Superintelligence (SSI). So far at least, it has not announced it has raised money, though it does say it has investors. Our take is both Sentient and SSI will need to raise a lot of money. If AI is anything, it is capital-intensive.

So what is Sutskever worried about? In a letter announcing the startup, Sutskever and his co-founders didn’t say directly, other than to launch a company that is devoted to the notion of a safer approach to superintelligence, which we take to mean AGI. Sutskever did reportedly clash with Altman over Open AI’s approach to AI safety.

SSI did say the following in its announcement. We haven’t heard much about SSI since the announcement in June.

“SSI is our mission, our name, and our entire product roadmap because it is our sole focus. Our team, investors, and business model are all aligned to achieve SSI.”

Recommended Reading

The following is a curation of content from around Africa and the world related to big tech, digital marketing, small business, startup life, venture funding, M&A, and more. Please vote with your clicks to tell us what we should curate for you in future editions.

Flutterwave, Kuda, Piggyvest Among CNBC Top Fintech Innovators

Flutterwave, OPay, Interswitch Among Top Fintechs by Valuation

Report Shows Growing Blockchain Funding in Africa

Three Univeral Reasons Why Small Businesses Fail

How ‘AI Exclusion’ is Hurting Africa

Cape Town Fintech Launches the ‘ZARcoin’

Egypt’s Pharmacy Marts a Northern Africa Startup Awards Winner

Will Bot Abuse Kill Influencer Marketing?

State of Payments in the UAE

UAE Foodtech Grubtech Featured in Forbes Middle East

From the 2024 BigFive Summit

The 2024 BigFive Summit (19-20 March) in Cape Town featured multiple high-impact presentations, panels, and fireside chats. We will continue to share a 2024 Summit video in each edition of this newsletter. And we will soon announce our plans for the 2025 BigFive Summit.

Today we are excited to feature a talk by Lee Naik, the CEO of TransUnion Africa. Naik has led TransUnion’s Africa operations since 2017. Naik was previously the managing director for Accenture in South Africa.

TransUnion currently operates in eight African markets — Botswana, Kenya, Namibia, Rwanda, South Africa, Swaziland, Zambia, and Malawi.

Naik’s talk focused on “Solving Africa’s Financial Inclusion Challenge.” This is a topic that Naik is personally passionate about. And it is a subject at the heart of TransUnion’s mission. As Naik puts it, “We are the largest credit bureau in Africa.”

Naik says that of the 17 sustainable development goals laid out by the United Nations, seven are “enabled by financial inclusion.” Naik adds that financial inclusion is the “single problem that we try to solve across the markets that we work in in Africa.”

Lee framed his talk around Africa’s incredible potential, driven by its young population, with an average age of 19 years. This contrasts with regions like Europe with fast-aging populations facing future declines as birth rates fall below replacement levels.

This comment sums up this point.

Yet, as his talk title suggests, Africa must overcome the financial inclusion challenge to fulfill its potential. Naik makes it clear that solving this challenge opens up countless opportunities.

Please enjoy Lee’s full 30-minute talk from BigFive Digital’s YouTube channel here:

Found on LinkedIn

We often share notable infographics that we come across while pursuing LinkedIn. This graphic, which we bring to you courtesy of Afridigest, shows how funding for African fintech companies, once a bright spot on the startup landscape, has fallen sharply.

As the graphic shows, more than $1.5 billion flowed into African fintechs in the first half of 2022. For the first half of this year, that number was only $340 million.

Globally, however, fintech has experienced a resurgence. According to CB Insights’ State of Venture Q2 report, fintech funding globally reached $8.9 billion in Q2 2024, which represents a 5-quarter high, according to the research firm. Massive ($600 million) funding rounds for Stripe and AlphaSense drove the rebound.

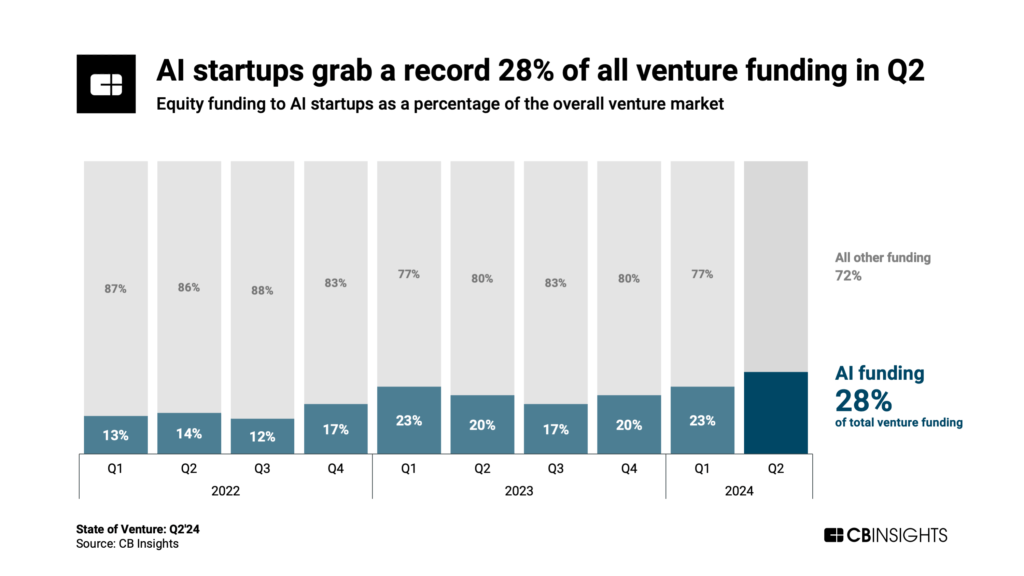

Another notable finding from the Q2 report was that AI-focused startups accounted for 28% of venture funding globally in 2024.

The Big5D Podcast

The BIG5D Podcast features in-depth conversations with the leaders who are building, investing in, or taking to market the digital products and services designed to make businesses more successful in Africa and the Middle East.

The BIG5D Podcast is available on Substack as well as on Apple Podcasts, Spotify, YouTube, or wherever you listen to podcasts. Please follow, comment, rate, and review the BIG5D Podcast. Your engagement helps others discover us so they can learn more from the amazing builders and thought leaders we feature on the show.

Coming Monday

On Monday, 22 July we will release the 48th episode of the BIG5D Podcast. This episode features an accessible yet in-depth conversation on fintech with Houssam Kayyal, the Chief Revenue Officer at Foo, a Dubai-based B2B fintech offering banking-as-a-service and other solutions for retailers, banks, telecoms, and other corporates. Tune in on Monday for an educational and thought-leading discussion.

To recommend a guest for the podcast or discuss sponsoring an upcoming episode, please write to us at info@bigfivedigital.org.

Please stay tuned for information on future BigFive Digital live and virtual events. The next BigFive Summit will return to Cape Town in March 2025.

Recent BIG5D Podcast Episodes

Would you like your brand’s message to reach our highly engaged audience of corporate decision-makers, investors, and thought leaders?

Consider sponsoring an episode of The BIG5D Podcast.